Low-risk starting options available — small tweaks, performance improvements, and SEO fixes

Build Momentum with Small Wins

Many lenders begin with focused, low-risk improvements before scaling further.

Discuss a Small ImprovementNo commitment · No sales pressure · Clear scope

Unlock smarter lending with mortgage tech that increases conversions and cuts manual work

From rate automation to borrower AI — everything you need to grow faster, convert better, and close more loans

Frictionless borrower journeys

We craft intuitive borrower flows — from first visit to closing — so every step feels smooth, fast, and conversion-optimized… so you turn more visitors into funded borrowers.

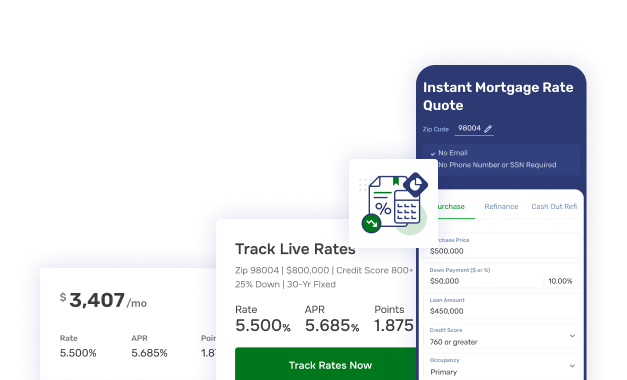

Rate quote tools that actually convert

Engage prospects with real-time Rate Quote Engines, calculators, and affordability tools fully connected to your LOS and pricing data… so your loan officers spend less time quoting and more time closing.

Real-time rate alerts & market insights

Stay ahead of rate shifts with automated tracking, personalized alerts, and daily pricing updates… so your team reacts faster and locks more loans at the right time.

Workflow automation that saves hours

Automate document collection, borrower notifications, and status updates with smart workflows… so you reduce manual effort and close more loans with the same team.

AI-driven lead scoring & follow-up

Identify and nurture high-intent leads with machine learning that triggers the right follow-ups automatically… so you convert more applications without extra marketing spend.

Back-office visibility at scale

Empower your team with dashboards, pipeline overviews, and AI-powered admin tools built for volume lenders… so operations run smoother and decisions happen faster.

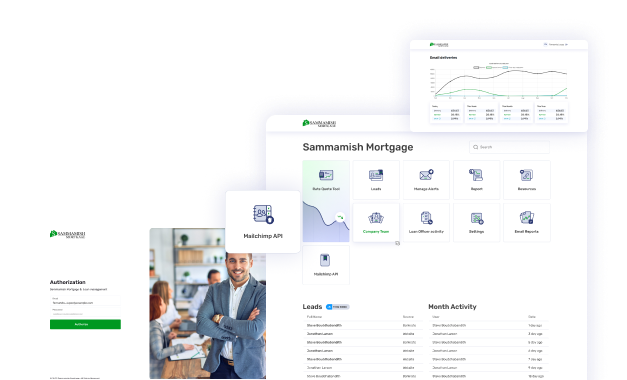

Case 1

Sammamish Mortgage got +72% conversion rate boost, improving from 3.2% to 5.5%.

+25% improvement in lead quality, attracting more qualified borrowers ($500K+ loans, $80K+ income).

Intelligent tools increased customer retention by 12%.

Automated data transitions between systems, reducing friction in loan processing.

Over 10,000 loans closed easier with the new online tools, with over $4 billion funded.

Case 2

1st Rate Home Mortgage, Inc. raised daily clients per LO from 3 to 6.

Agents can deliver quotes on-site in <30 seconds.

+20–30% increase in agent-driven referrals.

Estimated savings: $18,000–$22,000 per team/year.

Assistant workload reduced by 40–50%.

Lead conversion almost doubled.

What You’ll Actually Get

Higher Loan Conversion with Optimized Digital Journeys

Time-Saving Automation That Scales With You

Smarter Client Engagement from First Click to Close

How most clients start working with us

01.

Small improvements (2–3 weeks)

02.

Measured outcomes & clarity

03.

Decide whether to scale

Decade-long expertise brought to your mortgage business

Industry knowledge

Technical excellence

Security and compliance

Industry knowledge

Software engineers that have in-depth understanding of the mortgage lending process, mortgage origination systems, and can clearly tell the difference between various loan types: Conventional, FHA, VA. On top of that, good awareness of US governmental mortgage regulations and compliance principles.

Not having to explain mortgage business specifics to your software developers

Fewer research hours — lower development budget

Faster turnaround

Technical excellence

Engineers with strong technical background and ultimate confidence in what they do. Carefully-selected technical approaches, no redundant code, and adhering to approved coding conventions - all to help you get a reliable, fast and easily-scalable software for your mortgage business.

Strong confidence in technical accuracy of your software

Blazing-fast software that feels sleek to anyone using it

Integrations done right to deliver accurate calculations

Security and compliance

Whether we are building a rate tracker app or a rate engine, we help you collect sensitive user data, so that you could serve your customers with the best rate quotes available to them. Adhering to security standards is our strict rule, so we know what it takes to do it right.

Knowing your data is secured and protected. Having regular security audits and penetration testing performed

Feeling safe against security breaches and API-call high-volume attacks

Robust data encryption. Secure authentification and authorization mechanisms

Latest projects

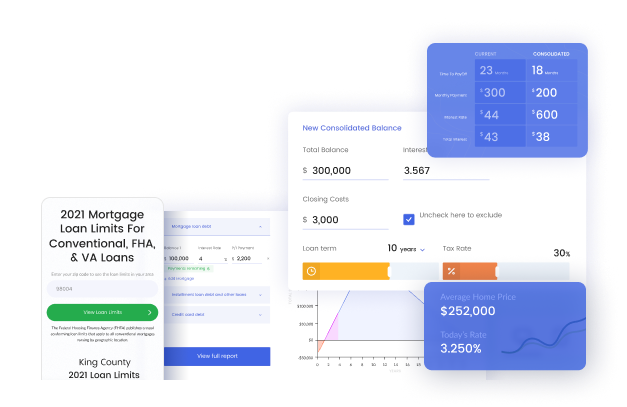

Our mortgage software solutions include

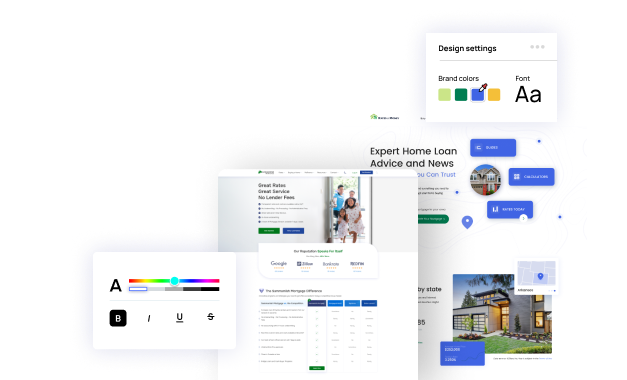

Custom mortgage websites

Get a custom-designed, SEO-optimized website that reflects your brand identity and mortgage style, ensuring fast performance and strong search visibility — all while seamlessly capturing leads through user-friendly forms.

See example

Loan officer dashboards

Loan officer dashboards bring all client data, loan updates, and communications together in one place, allowing officers to track key performance metrics and customize views to match their individual needs and workflows.

See example

Rate quotation tools and rate tracker apps

Deliver real-time, accurate mortgage rates from trusted sources, with customizable alerts that notify users of changes and access to historical data that helps them make informed loan decisions.

See example

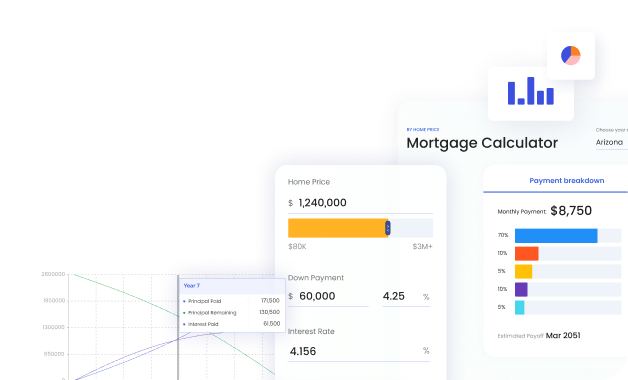

Mortgage, refinance, and other calculators

Provide accurate loan estimates, payment breakdowns, and amortization schedules through an intuitive, user-friendly interface that lets users customize parameters and instantly see tailored results.

See example

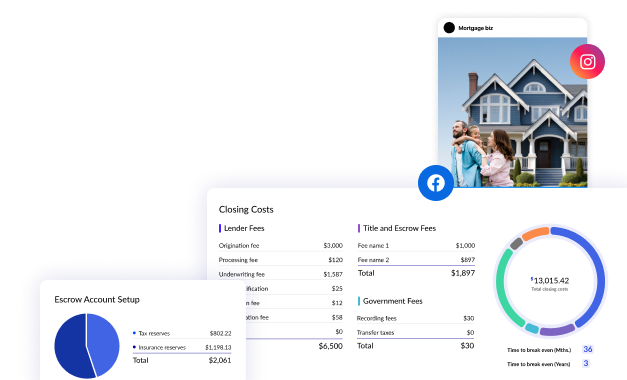

Mortgage-specific CRMs and marketing tools

Manage client interactions, loans, and follow-ups in one place while automating marketing via email, SMS, and social media — all backed by powerful analytics for deeper performance insights.

See example

Mortgage branding design

Build a professional, brand-tailored online presence with responsive layouts that adapt to any device and seamlessly integrate with mortgage calculators, CRMs, and other essential platforms.

See example

Build a next-gen mortgage tool and stand out from traditional lenders

Automated advisory & offers

Let borrowers get personalized offers instantly — no waiting, no manual reviews — so you capture leads while competitors are still processing forms.

Faster application processing

Automate rate selection, document collection, and pre-approvals in one flow — so you close loans days faster and deliver a seamless borrower experience.

Increased productivity

Give your loan officers AI-driven dashboards and borrower insights — so they handle more clients with less effort and zero burnout.

Real-time data accuracy

Integrate with leading PPEs and LOS platforms to keep rates, pipelines, and borrower data always up-to-date — so you make confident decisions every time.

Effortless compliance

Stay ahead of evolving regulations with built-in audit trails and automated updates — so compliance never slows your growth.

Frequently asked questions

No. Many clients begin with a small, clearly defined scope focused on improving specific areas of their website. This allows you to evaluate our approach, collaboration style, and impact before considering larger initiatives.

Yes. A significant portion of our engagements start with targeted fixes or optimizations — such as stability improvements, performance tuning, SEO enhancements, or light UX/UI refinements — without committing to a full rebuild or long-term project.

A low-risk engagement typically focuses on a small, clearly defined set of improvements with a predictable scope and timeline. It usually involves addressing specific technical issues, improving website performance, strengthening on-page SEO, or making light UX/UI refinements to key pages. The goal is to reduce friction, improve how the website functions today, and provide clarity on what further improvements may be valuable, without committing to a large rebuild or long-term project.

No. There is no obligation to continue beyond the initial scope. After the first phase, you can decide whether to pause, extend the engagement, or explore larger initiatives based on your priorities and outcomes.

We build everything your lending ecosystem needs — from interactive mortgage calculators and real-time rate quote tools to custom compliance modules, automated borrower workflows, and property valuation integrations. Each solution is tailored to your tech stack and business model — so your team works smarter, faster, and fully compliant from day one.